Banking apps used to serve a simple role of checking balances, transferring money, or paying bills. However, in recent years, this landscape has dramatically changed. Names like MB Bank, Techcombank, Vietcombank, TNEX, Nam A Bank, VIB, Timo… are gradually transforming banking apps into “financial super apps” with a closed ecosystem. Features such as spending management, budgeting, savings reminders, and financial habit analysis have been integrated directly, opening up an entirely new game.

This change raises an important question: will independent spending management apps like Money Lover, Sổ Thu Chi… still be able to survive when banks have entered this playing field?

Users are more attached to digital banking than ever

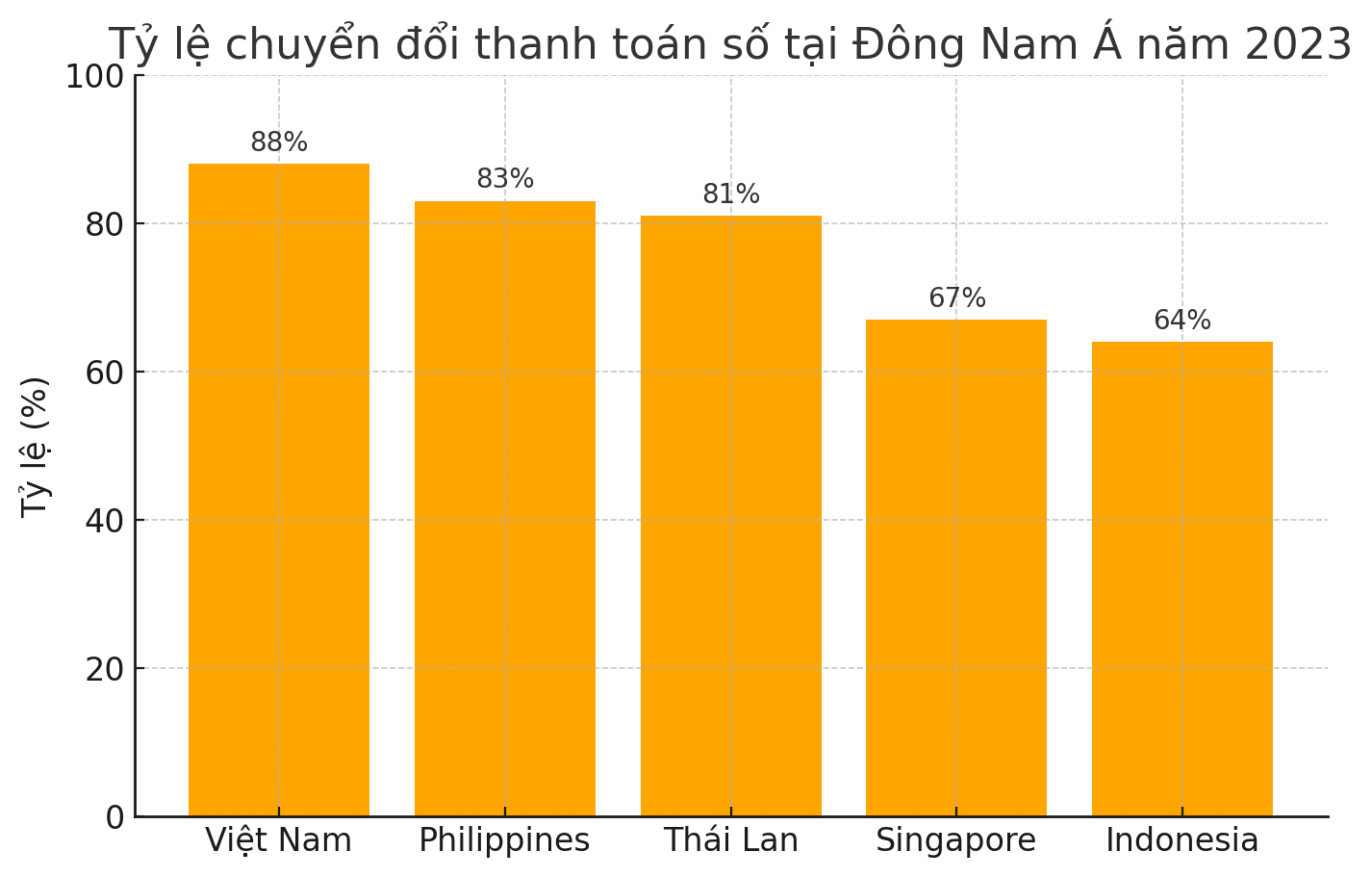

According to Visa’s statistical report in 2023, Vietnam leads in digital payment transformation in Southeast Asia, with 88% of consumers not using cash for transactions. The online transaction rate in Vietnam’s banking sector reaches up to 90%. MB Bank is one example, as in 2023, this bank recorded 96.7% of total transactions conducted through digital channels.

This figure clearly reflects that users no longer open banking apps just to transfer money. They use this app daily to pay bills, top-up mobile phones, save, invest, and even participate in insurance right within a single platform.

This level of engagement has created a significant advantage for banks as they begin to expand into personal financial management.

How banking super apps operate

A banking super app goes beyond just financial services. Techcombank and Vietcombank have added features such as automatic spending categorization, goal-based budgeting, periodic savings reminders, and visual financial reports. MB Bank has now integrated many mini apps to serve diverse needs from payments, investments to booking flights and hotels.

Other banks like TNEX, Nam A Bank, VIB, and Timo also offer interesting features that attract users to their apps. TNEX allows users to set spending limits, track financial charts, and receive alerts when spending excessively.

Nam A Bank has implemented a feature to note income and expense transactions and provides financial balance reports directly within the Open Banking app.

VIB, with the MyVIB app, has made spending management a core part of the user experience. Timo, the digital bank of BVBank, has even integrated spending management with smart investment planning, creating a more comprehensive financial ecosystem.

The underlying technology enabling banks to implement these features includes transaction classification codes (MCC) for automatic recognition of spending categories, transaction keyword analysis to accurately identify spending types such as dining or shopping, and AI machine learning systems that improve accuracy over time. As electronic invoices are widely adopted, banks can almost automatically categorize users’ entire spending without needing manual data entry.

Independent spending apps at risk of being “swallowed up”

The push by banks to integrate spending management features poses a significant challenge for independent apps. Average users, who only need a simple tool to track spending, will have less reason to download another app when everything is already available within the banking app. As the behavior of opening banking apps is repeated multiple times a day, accompanying features like spending management naturally become habits without any effort to change.

However, the market is not entirely closed off to specialized spending apps. Their strengths lie in the ability to analyze multi-source data from various bank accounts, e-wallets to investment tools, while providing more detailed reports and long-term financial planning capabilities that banking apps currently cannot offer.

Additionally, some spending apps are also looking to collaborate directly with banks, integrating as complementary tools instead of competing directly.

The shift of banks from pure financial apps to super apps reflects an inevitable trend in the market. As transaction data and AI analysis technology continue to improve, banks will gradually take on the central role in personal financial management.

If independent spending apps do not innovate quickly, they will likely face the risk of losing market share. Conversely, if they can leverage their specialized strengths and collaborate cleverly with banks, they still have the opportunity to find their place in this new financial ecosystem.

The Better Choice Awards is a prestigious annual national award co-organized by VCCorp Joint Stock Company in collaboration with the National Innovation Center, under the direction of the Ministry of Finance. With this year’s anticipated theme being “Breaking Through” along with the overarching spirit of “Proudly Vietnamese”, the award affirms the spirit of overcoming all limits, promoting innovation, and breaking down old barriers.

In the context of the personal finance sector witnessing significant advancements (from digital banking, fintech to technology insurance), the Consumer Finance Awards category has been proposed to recognize and encourage financial initiatives aimed at individual users. This category will be a prestigious playground where outstanding financial organizations and products compete healthily, while spreading intelligent financial solutions that enhance the experience and quality of life for citizens.

The award is expected to kick off in early August and conclude in October 2025. Currently, it has entered the phase of receiving registration nomination applications, starting from July 24, 2025. For any inquiries during the preparation and submission process, please contact phone number: 093.981.7900 and email [email protected] (Ms. Vi Hanh)